Is your company getting the most out of its group health plan?

A team of benefits experts can help you find out — at no cost. No sales pitch, no pressure, no gimmicks. It’s a courtesy consultation, and it’s included with your membership.

Working with a licensed benefits counselor you’ll receive a complimentary market analysis that will help you answer critical questions such as:

- Are you aware of all the options? (Did your broker look into pooled risk opportunities for you? Or association health programs?)

- Are you getting the best pricing? (Has your broker explored return-of-premium options? Did they offer any kind of concessions on ancillary benefits?)

- How does your service compare? (Did your broker create a free online benefits portal for you? Are you receiving an updated plan analysis every year? Do you have access to a service team?)

Our unique approach.

Easily control your business’s healthcare expenses while providing more personalized coverage options to your employees. From on-boarding to health insurance and everything in between, take care of all of your employee benefits needs by creating your custom online benefits portal.

Our team of experts will identify the best group health solution for you based on your company’s unique needs — and then we’ll customize an online portal that gives your employees access to an array of competitive employee benefits from industry-leading carriers.

Ready to start your free estimate?

A broad range of benefits for you and your employees.

Your custom package comes with a preinstalled voluntary ancillary benefits platform similar to what a Fortune 500 company offers their employees. Don’t want to offer all of them? You can easily remove ancillary benefits at any time. You’ll also have the ability to contribute funds to help your employees cover costs. It’s all up to you. Whatever works for your business, we’ll make it easy. (Please note that availability of certain ancillary benefits will vary based on your SIC code.)

Coverage from leading benefits providers.

Complimentary industry-leading enrollment technology included.

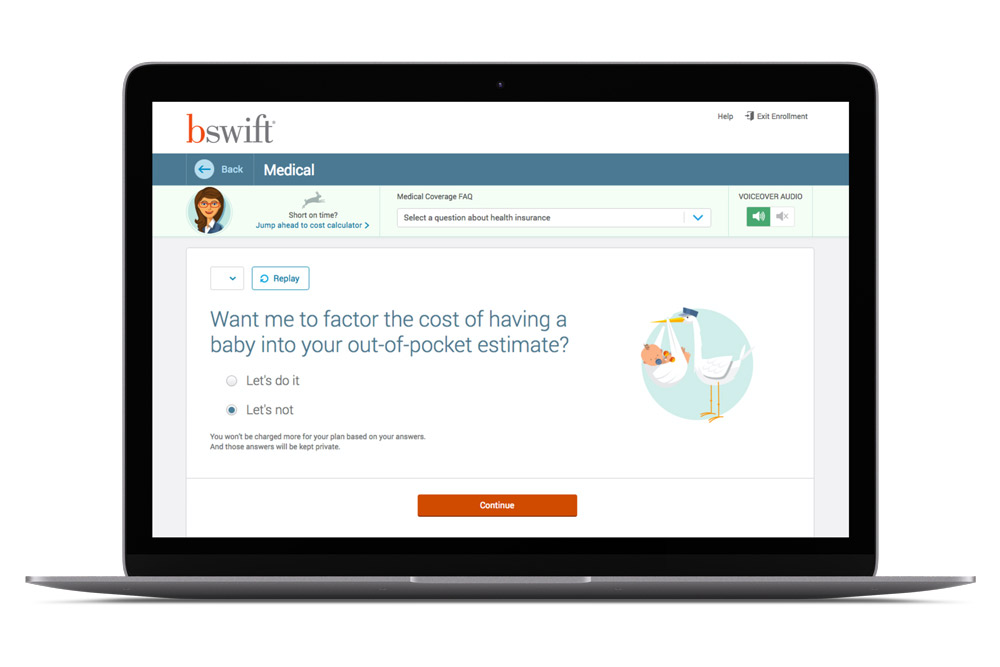

Our enrollment technology solutions are designed to make it easy for you to manage employee benefits — and make it simple for your employees to find the options they need.

A decision support tool is built right into your platform. By answering a few short questions, employees can find the plan that best suits their needs. Other support features include a filtering tool, plan comparisons, and provider search tools.

If an employee still has questions they can use the live chat or call to get the advice of one of our experienced benefits counselors.

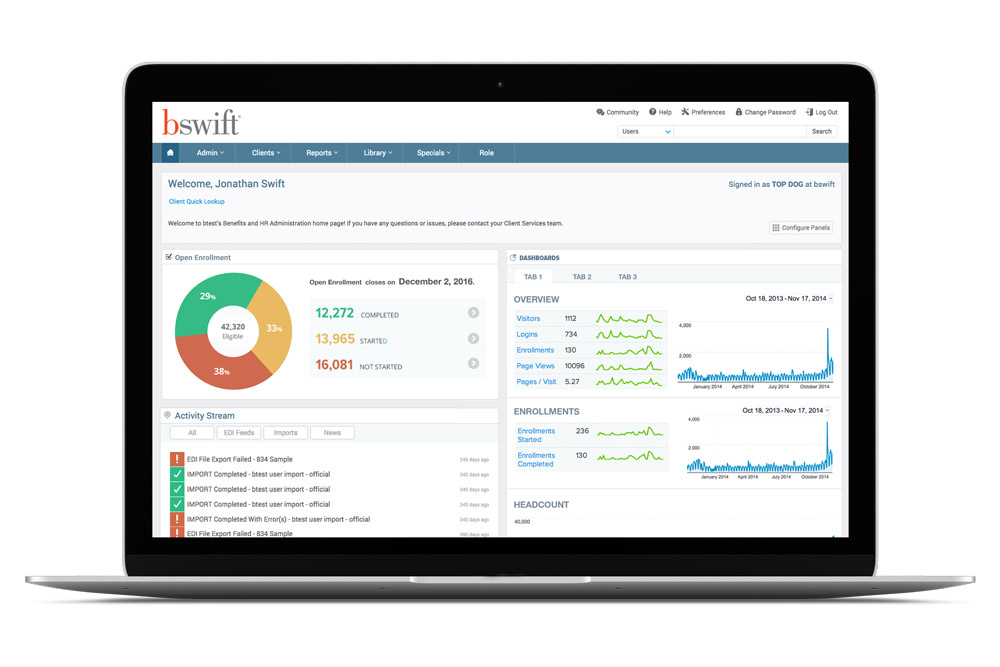

The HR Admin Portal is your source to manage your employees benefits. Once in the portal, you have access to real-time reporting tools that include almost any report you would ever need, and more!

Advanced billing features makes it easy for you to run monthly reports, apply retroactive adjustments, apply fees as appropriate, self bill, reconcile bills against carrier bills, and separate bills based on location, department, division or benefits status.

Make employees more aware of the investment you are dedicating to them with Total Compensation Statements. All enrollment information is already stored and the system can accept additional data such as payroll, 401(K) and more.